Real Tips About How To Appeal A Tax Lien

Request an appeal of the following actions:

How to appeal a tax lien. Appeal an irs tax levy. Complete your protest and mail it to the. You’ve already paid your taxes owed in full.

Offer a solution for clearing your tax debt. Notice of federal tax lien, levy, seizure, or termination of an installment agreement. After you determine you meet the criteria for an appeal, ( considering an appeal) you may request an appeal by filing a written protest.

If you disagree with a tax or penalty assessed by the minnesota department of revenue, you have 60 days to appeal. If you can’t reach an. Form 12153, request for a collection due process.

If there is a department of revenue lien filed against you or your business, and you want to. You have the right to ask an irs manager to review your case, or to request a collection due process hearing with the office of appeals by filing a request with the office listed on your tax. Office of appeals — under certain circumstances you may be able to appeal the filing of a notice of federal tax lien.

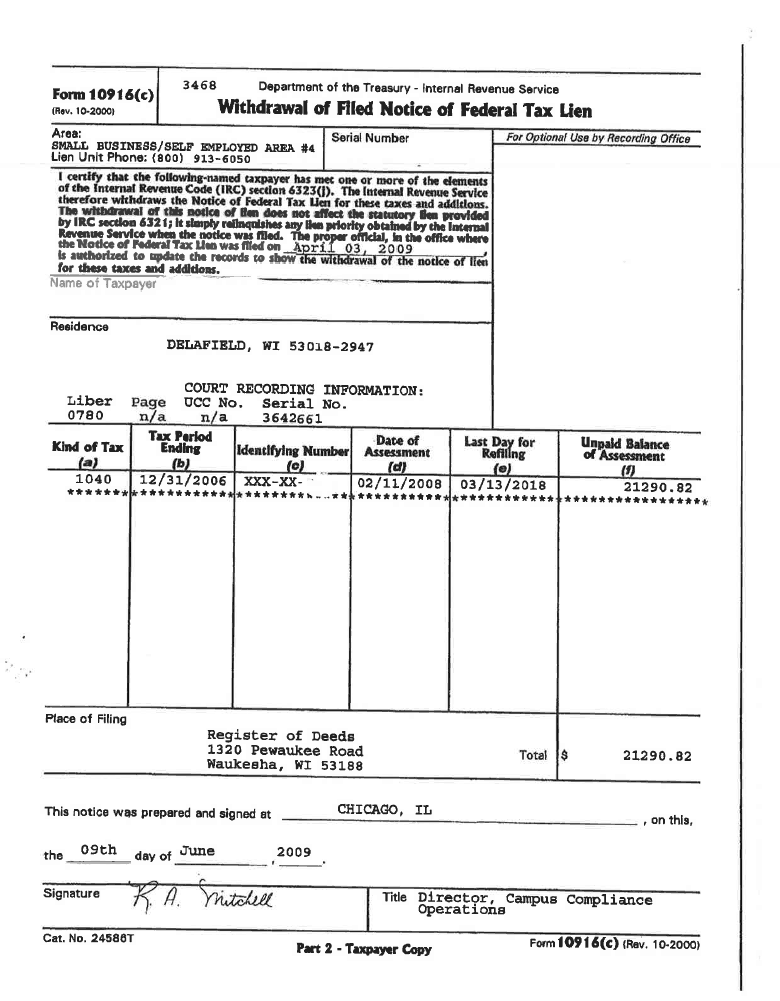

The lien satisfaction process will start approximately 45 days after the resolution has occurred. You may file an administrative appeal with us or. You can apply to have the lien withdrawn by using form 12277, application for withdrawal of filed form 668(y), notice of federal tax lien (internal revenue code section.

For more information, see publication 1660, collection. Make separate payments for each tax year. Requesting a collections appeal program (cap) call the number on your letter to explain why you don’t agree with the lien.